How Student Loans Became a Business Model, Not a Support System

Student loans were never meant to be controversial. They were designed as a simple promise: if you’re capable, money shouldn’t stop you from getting an education. For decades, loans functioned as a support system—imperfect, but limited, and largely tied to the expectation that a degree would lead to stable work.

Somewhere along the way, that promise quietly broke.

Today, student loans look less like financial aid and more like a business model—one that generates revenue whether students succeed or fail.

From Access to Assumption

Originally, student loans were supplemental. Tuition was relatively affordable, public funding was stronger, and borrowing was an exception rather than the rule. Loans existed to bridge short gaps, not to finance entire degrees.

Over time, however, borrowing shifted from being available to being assumed. Tuition rose faster than wages, and instead of asking why education was becoming so expensive, the system offered a convenient solution: borrow more.

Once borrowing became normal, affordability stopped being a constraint. The question was no longer “Can students pay this?” but “Can they get approved for loans?”

Guaranteed Money, No Accountability

The critical turning point came when student loans were widely guaranteed by governments. This removed risk from lenders and, indirectly, from institutions themselves.

Colleges were paid upfront.

Lenders collected interest over time.

Students carried the risk alone.

Whether a student graduated, found employment, or earned enough to repay their loans became almost irrelevant to the institutions receiving the money. In any other market, a product that consistently failed its customers would collapse. In higher education, it expanded.

When Tuition Followed the Credit Limit

Easy credit has predictable consequences. As loan limits increased, tuition followed. Universities learned that price resistance had disappeared because students were insulated from the real cost—at least temporarily.

Financial aid offices evolved into complex loan-processing hubs. Instead of asking how to reduce costs, the system focused on packaging debt in ways that looked manageable: monthly payments, deferred interest, income-based plans.

The true cost was pushed far into the future, where it was easier to ignore.

The Rise of Loan-Driven Colleges

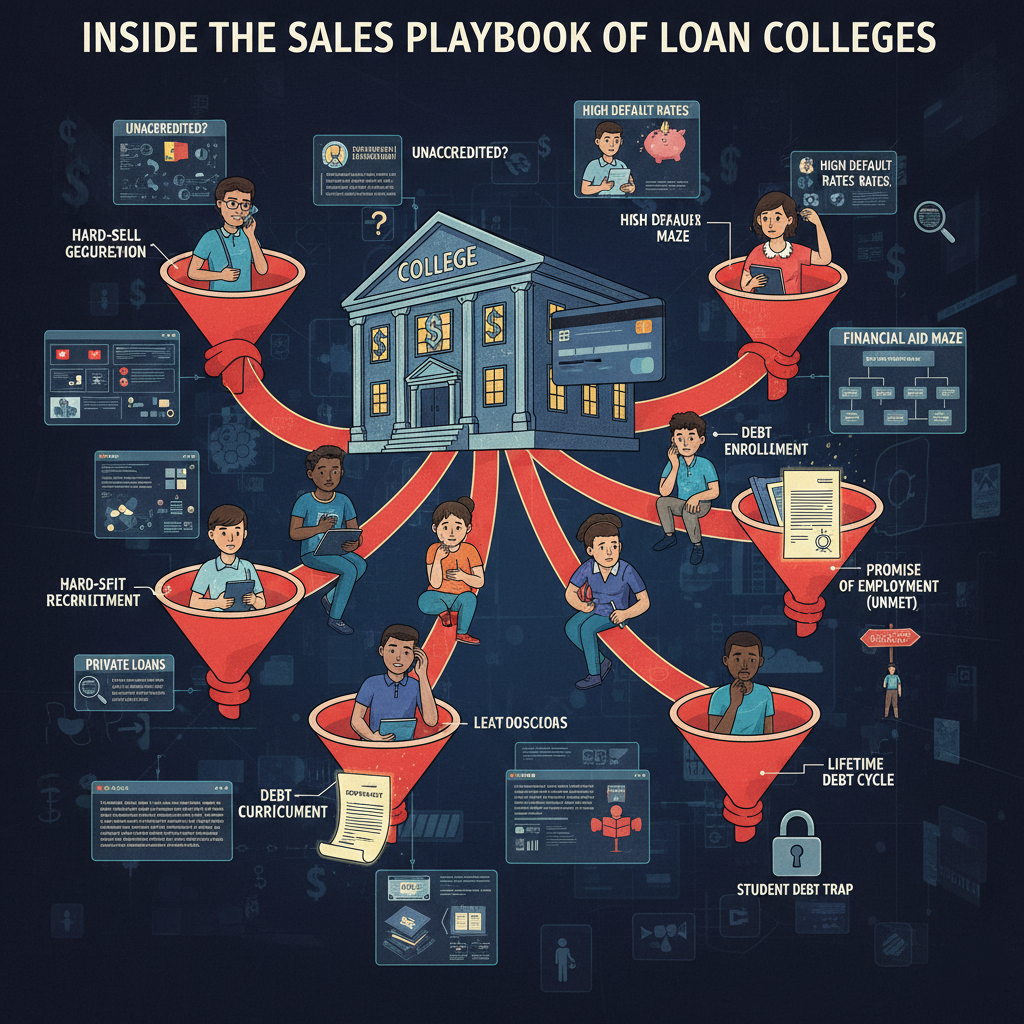

For-profit colleges recognized the opportunity early. They didn’t need elite faculty, strong research programs, or long-standing reputations. They needed one thing: access to student loan money.

Aggressive marketing, emotional messaging, and fast enrollment pipelines became the strategy. Many of these institutions spent more on advertising than instruction, operating less like schools and more like lead-generation companies.

Education was no longer the product. Loan eligibility was.

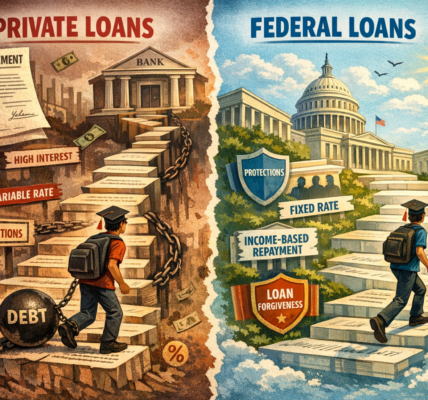

Complexity as Control

As the system grew, it became increasingly complex—multiple loan types, shifting interest rules, confusing repayment options, and servicers offering inconsistent advice. Complexity discouraged scrutiny and delayed resistance.

Borrowers rarely saw the full picture until repayment began, often years later. By then, the debt felt permanent, and responsibility had been fully individualized.

If you struggled, the narrative suggested, you made a poor choice—not that the system was poorly designed.

A Market Where Failure Pays

In most markets, failure carries consequences. In student lending, it doesn’t.

A degree that doesn’t lead to employment still generates tuition revenue. A student who drops out still owes debt. Even default feeds the system through fees, penalties, and extended repayment timelines.

The model doesn’t depend on student success. It depends on continuous borrowing.

Why This Matters

When student loans function as a business model rather than support:

Costs rise without restraint

Risk shifts entirely to individuals

Inequality deepens

Education loses its credibility as a public good

Most troubling of all, debt becomes normalized—not as a temporary tool, but as a lifelong condition tied to learning.

Rethinking the Purpose of Loans

Student loans were meant to open doors, not trap people behind them. Reimagining the system requires reconnecting funding to outcomes, restoring accountability, and treating education as more than a revenue stream.

Until then, the question isn’t whether student loans are broken.

It’s whether they’re doing exactly what they were redesigned to do.