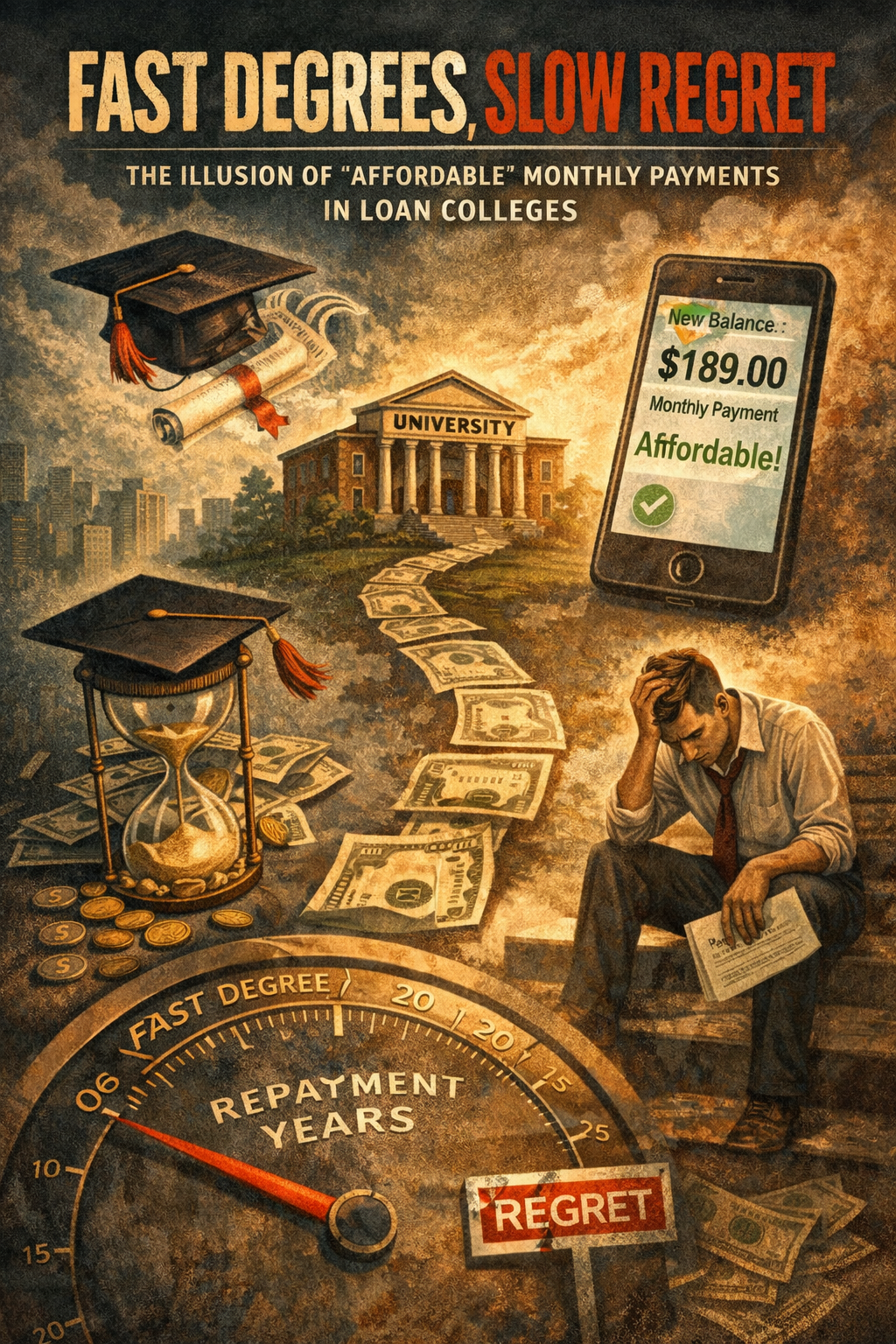

Loans, Debt & the Fine Print: The Interest You Never See Until It’s Too Late

“Did you actually read the fine print?”

Most people laugh at that question. Of course, not—who does? When you’re applying for a loan, you’re not thinking about clauses and capitalization. You’re thinking about relief. About the door this money is supposed to open.

That’s where the problem starts.

Loans rarely arrive looking dangerous. They show up dressed as opportunity: affordable monthly payments, flexible terms, no pressure now—figure it out later. The language is calm, reassuring, almost friendly. But buried beneath that tone is a different reality, one that only reveals itself after the ink dries.

Here’s an uncomfortable truth: interest is working against you long before you realize you’re in trouble.

While borrowers focus on surviving classes, jobs, or daily expenses, interest is quietly compounding in the background. Not loudly. Not dramatically. Just consistently. It doesn’t wait for your income to stabilize or your plans to work out. Time is its favorite weapon.

And then there’s the fine print—the part no one explains out loud.

Interest that capitalizes, meaning unpaid interest gets added to the principal, so you end up paying interest on interest. Rates that adjust upward after an introductory period. Grace periods that expire without warning. Penalties triggered by a single missed or late payment, even if you’ve been “good” for years.

None of this is hidden in the sense of being illegal. It’s hidden in the sense of being inconvenient to understand.

The system doesn’t rely on you failing. It relies on you staying. Staying hopeful. Staying compliant. Staying just solvent enough to keep paying. Long-term debt is more profitable than short-term collapse.

That’s why so many borrowers have the same haunting realization years later:

“I’ve been paying for a decade. Why do I still owe almost the same amount?”

By then, the cost isn’t just financial. It’s postponed choices—delayed homes, delayed families, delayed freedom. Debt doesn’t always destroy lives all at once. Often, it erodes them quietly, month by month, statement by statement.

So here’s the question we don’t ask often enough:

At what point does “help” turn into a trap—and who benefits from that confusion?

Because once you understand how the fine print really works, one thing becomes clear: the most expensive part of many loans isn’t the money you borrow. It’s the time you lose before realizing what you agreed to.